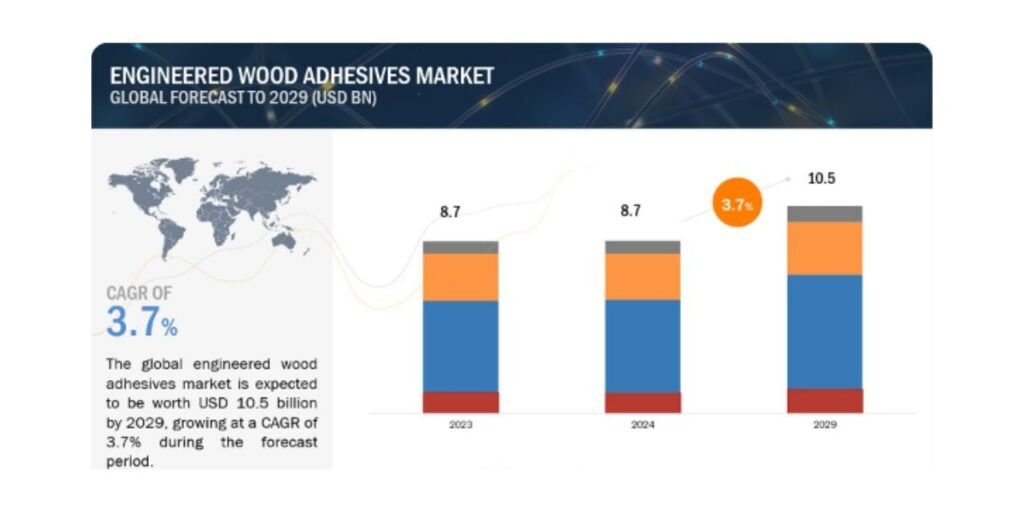

With a compound annual growth rate (CAGR) of 3.7%, the size of the “Engineered Wood Adhesives Market by Resin (Melamine Formaldehyde, Phenol Resorcinol Formaldehyde), Product (CLT, OSB, MDF, LVL), Technology (Solvent-Based, Water-Based), Application (Structural, Non-Structural), and Region – Global Forecast to 2029” report is expected to increase from USD 8.7 billion in 2024 to USD 10.5 billion in 2029. The market for engineered wood adhesives is expanding due in large part to the growing demand from the construction sector for healthier and environmentally friendly adhesives as well as the growing requirement to enhance performance, durability, and aesthetics. Global market participants may anticipate more growth potential as a result of the increasing investment in emerging economies. Regulatory measures that are both time-consuming and rigorous present a burden to market participants.

Download the brochure in PDF format.

Look around

189 Tables with Market Data

73 Illustrations

The “Engineered Wood Adhesives Market – Global Forecast to 2029” has a detailed TOC and 309 pages.

Among the well-known pivotal figures are:

· H.B. Fuller Company (United States)

· Germany’s Henkel AG & Co., KGaA.

· AkzoNobel N.V., located in the Netherlands

· Arkema SA, located in France

· German company BASF SE

· Dow Jones (US)

· The US-based Huntsman Corporation

· AICA Kogyo Co., Ltd., a Japanese company

· Astral Limited, an Indian company

· Hexion, the United States

The melamine formaldehyde section of the engineered wood adhesives market is predicted to have one of the greatest compound annual growth rates based on resin.

Notable is the performance of MF in engineered wood products. Because of its superior resistance to bases, acids, and solvents, it is the material of choice in chemically demanding situations. Furthermore, its capacity to give bonded structures mechanical strength is essential for preserving their integrity and longevity under physical strain. Controlled application of heat and pressure is necessary in manufacturing procedures employing metal fiber (MF) to enable efficient curing, which is essential to attaining the best possible bond strength and stability.

But there are several issues with using MF. Because formaldehyde is a proven carcinogen, there are serious health dangers associated with its presence in the resin. Tighter regulations on formaldehyde emissions from wood products, including as those from the U.S. Environmental Protection Agency (EPA) and European Union guidelines, are forcing producers to create MF formulas with reduced emissions. Technological developments are also concentrating on improving the resin’s characteristics by altering catalysts and hardeners in an effort to decrease emissions even more and accelerate the curing process.

Ask for example pages.

The plywood segment is expected to account for one of the largest share in 2023.

Because of its reputation for strength and adaptability, plywood continues to be a mainstay in the industrial and construction sectors. Plywood panels are made from thin sheets of cross-laminated veneer, which are fused together with powerful adhesives and heat. Because of this technique, plywood has an exceptional strength-to-weight ratio and better dimensional stability, which makes it a great material for a variety of structural applications. Additionally, plywood’s ability to withstand impacts, chemicals, and temperature and humidity variations makes it more useful in harsh conditions.

In 2023, Asia Pacific is anticipated to have the most share.

In terms of revenue, the engineered wood adhesives market was dominated by the Asia Pacific region in 2022, and this trend is expected to continue through 2029. Key participants in the area include China, Japan, and Thailand, with China holding the greatest market share. Its strong manufacturing capabilities and the rising demand for adhesives of the highest caliber sustain its supremacy. The Asia Pacific construction sector grew significantly in 2022 while confronting economic headwinds, mostly because to the region’s leading nations’ high demand for residential buildings. In addition, there was a noticeable rise in the amount of money invested in infrastructure projects, and local construction firms were aggressively looking to enter new markets.

Send in a Request

Top Related Reports on the Coatings, Adhesives, Sealants, and Elastomers Industry may be downloaded in PDF format.

· Medical Adhesives Industry

· Wood Adhesives Industry

· Waterborne Polyurethane Industry

· Automotive Adhesives Industry

· Specialty Tapes Industry