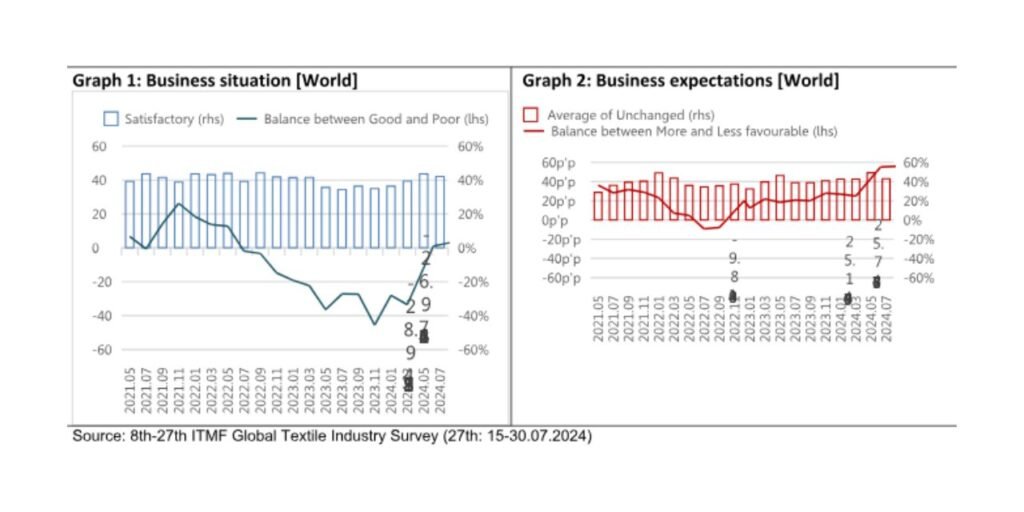

The business situation is bad, but prospects are positive.

According to the ITMF’s July 2024 Global Textile Industry Survey (GTIS), the global textile value chain continues to face significant commercial challenges. Despite a challenging economic environment and limited order intake, company projections for the next six months remain optimistic. Maintain an optimistic attitude. This highly mixed picture demonstrates that firms expect this. A sluggish business cycle that has lasted for an extraordinary length of time must finally terminate.

In July, order intake increased marginally (-20pp) compared to May (-24pp), and is much higher than the -50pp in November 2023. Despite a minor decrease from 71% to 68%, the capacity utilization rate hit its lowest point in late 2023. The Outlook Both order intake and capacity utilization rates are not showing a significant improvement.

The main source of worry throughout the textile value chain has been and continues to be sluggish demand. 66% of interviewees reported weak demand as a serious problem. That geopolitics

is now the second major concern (40%) shows that investors’ and consumers’ sentiments are suffering from wars and geopolitical tensions. High costs remain a challenge too, especially higher logistical costs (24%) due the problems related with the access to both the Suez and Panama Canals but also energy costs (22%) and raw material costs (27%).

Order cancellations are not as prevalent as they were following the Corona outbreak. Inventory levels are also average and do not pose a major concern for companies along the textile value chain. This was different with retailers and brands that struggled since the end of 2022 with unprecedented inventory levels. In the meantime, they have fallen to a level where it can be expected that they will place more orders again in the coming months.

For more information, please see www.itmf.org or contact secretariat@itmf.org.