Rieter Investor Update 2024:

• Order intake was CHF 629.8 million after nine months, and CHF 226.4 million in the third quarter.

As of September 30, 2024, the order backlog was around CHF 690 million. Sales were CHF 163.3 million in the third quarter and CHF 584.3 million after nine months. The outlook for the entire year 2024

With the exception of China, the market situation during the reporting period was marked by cautious investment in new machinery. Because of the low spinning mill capacity utilisation, there was a modest decline in demand for consumables, wear and tear, and replacement parts. The whole textile value chain was further dampened by the apparent decline in consumer sentiment.

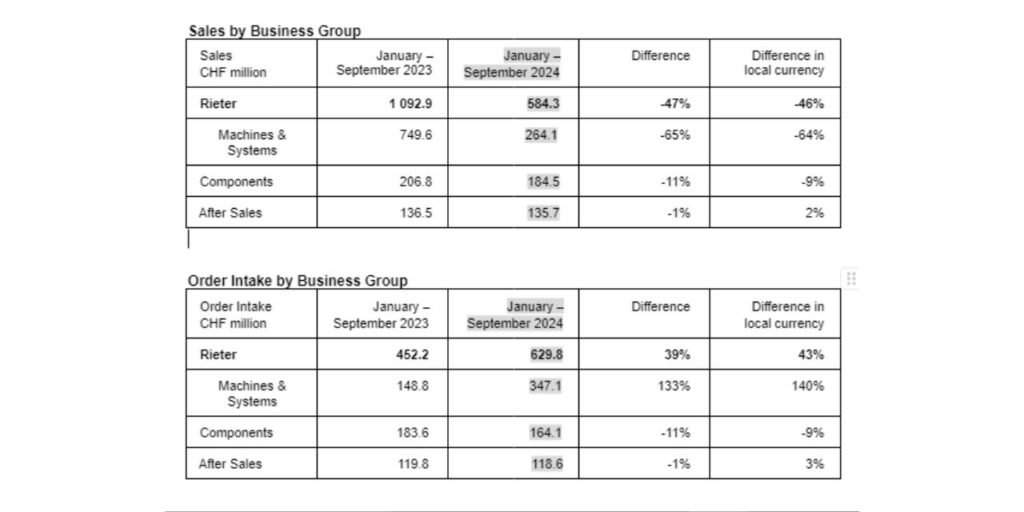

The Rieter Group reported a satisfying order intake of CHF 629.8 million in the first nine months of 2024 (2023: CHF 452.2 million) throughout all market areas, despite this difficult market climate. Orders climbed 78% year over year to CHF 226.4 million in the third quarter of 2024 (2023: CHF 127.2 million). This indicates that for the third consecutive quarter, the order intake has grown.

Purchases

In the first nine months of 2024, Rieter’s total sales came to CHF 584.3 million (2023: CHF 1 092.9 million), which was 47% less than the same period the previous year. Third-quarter 2024 sales came to CHF 163.3 million (compared to CHF 334.7 million in Q3 2023).

In the first nine months of 2024, Business Group Machines & Systems’ total revenues came to CHF 264.1 million, a 65% decrease from the same time the year before. Sales for the Business Group Components were CHF 184.5.

million in the first nine months of 2024, 11% less than in the same time the year before, while the Business Group After Sales had a little -1% drop to CHF 135.7 million. Backlog of orders Rieter’s order backlog as of September 30, 2024, is around CHF 690 million (September 30, 2023: CHF 900 million).

Performance program “Next Level”

In order to allow the major markets to react more quickly to consumer demands and cycles in the equipment industry, resources and responsibilities are being transferred to China and India. The anticipated cost reductions were realised. Rieter keeps carrying out the action plan regularly in order to boost profitability.

Prospects for the entire year 2024

The market rebound is turning out to be more muted than anticipated because of the broad decline in consumer morale and the overall geopolitical environment. In the fiscal year 2024, the initial indications of a recovery have shown in the

important Indian and Chinese markets. Rieter now projects revenues of CHF 900 million for the entire year 2024, with an EBIT margin of 2% to 4%.

Presentation Material

The media release can be found at: https://www.rieter.com/media/media-kit

Forthcoming Dates

• Capital Market Day October 28, 2024 • Publication of sales 2024 January 29, 2025 • Deadline for proposals regarding the agenda of the

Annual General Meeting February 28, 2025

• Results press conference 2025 March 13, 2025 • Annual General Meeting 2025 April 24, 2025 • Semi-Annual Report 2025 July 18, 2025 • Investor Update 2025 October 22, 2025

For further information please contact:

Rieter Holding Ltd. Oliver Streuli

Chief Financial Officer T +41 52 208 70 15 investor@rieter.com www.rieter.com

Rieter Ltd. Relindis Wieser

Head Group Marketing & Communication T +41 52 208 70 45

media@rieter.com

www.rieter.com

About Rieter

The world’s top supplier of spinning mill systems for turning staple fibres into yarn is Rieter. The firm, which has its headquarters in Winterthur, Switzerland, designs and produces equipment, systems, and parts that enable the most economical conversion of natural and synthetic fibres and their mixes into yarns. By using less resources, Rieter’s state-of-the-art spinning technology promotes sustainability throughout the textile value chain. With 18 manufacturing facilities spread across 10 countries and a global workforce of around 4,800 employees, including roughly 16% located in Switzerland, Rieter has been in business for more than 225 years.

Rieter is listed on the SIX Swiss Exchange under ticker symbol RIEN. www.rieter.com