The coverage of credit guarantees for micro and small businesses was increased from five to ten percent.

The first year will see the introduction of 10 lakh customised credit cards with a 5 lakh limit for microenterprises registered on the UDYAM portal.

For start-ups, a new fund of Rs. 10,000 crore would be established.

SCHEDULED CASES AND SCHEDULED TRIBES FIRST-TIME ENTREPRENEURS WILL BE STARTED, ALONG WITH A NEW SCHEME TO PROVIDE LOANS UP TO 2 CRORE FOR 5 LAKH WOMEN DURING THE NEXT 5 YEARS.

The objective of export promotion is to facilitate Announced: SIMPLE ACCESS TO EXPORT CREDIT AND ASSISTANCE FOR MSMEs IN MANAGING NON-TARIFF MEASUREMENTS IN OVERSEAS MARKETS

According to the Union Budget 2025–2026, the following five years present a special chance to achieve “Sabka Vikas,” promoting balanced regional growth and accomplishing the Viksit Bharat objective.

According to the Union Budget, MSMEs are one of the main forces behind development, and the suggested development initiatives help them to achieve inclusive development and boost growth.

Modifications to MSMEs’ categorisation standards

“To help MSMEs achieve higher efficiencies of scale, technological upgradation, and better access to capital, the investment and turnover limits for classification of all MSMEs will be enhanced to 2.5 and 2 times respectively,” stated Smt. Nirmala Sitharaman, Union Minister for Finance & Corporate Affairs, during her presentation of the Union Budget 2025–26 in Parliament today. Figure 1 contains the specifics. “This will give them the confidence to grow and create jobs for our young people,” she added.

| Rs. in Crore | Investment | Turnover | ||

| Current | Revised | Current | Revised | |

| Micro Enterprises | 1 | 2.5 | 5 | 10 |

| Small Enterprises | 10 | 25 | 50 | 100 |

| Medium Enterprises | 50 | 125 | 250 | 500 |

Smt. Nirmala Sitharaman, Union Minister for Finance & Corporate Affairs, said that more over 1 crore registered MSMEs, which employ 7.5 crore people and account for 36% of our manufacturing, have united to establish India as a worldwide manufacturing powerhouse. She said, “These MSMEs account for 45% of our exports due to their high-quality products.”

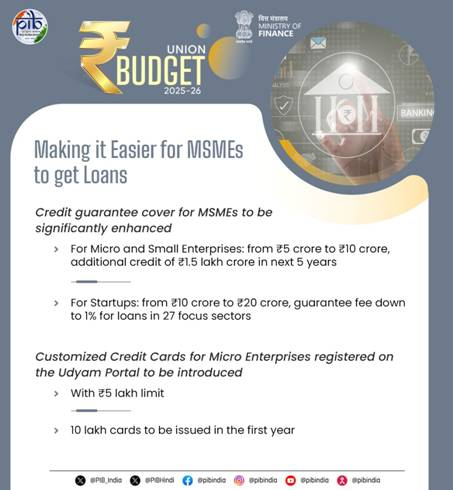

Credit availability is significantly increased with guarantee cover.

According to Smt. Nirmala Sitharaman, Union Minister for Finance & Corporate Affairs, the credit guarantee cover would be increased in order to increase credit availability:

a) from 5 crore to 10 crore for micro and small businesses, which will result in an extra 1.5 lakh crore in loans over the following five years;

b) For startups, the guarantee cost for loans in 27 key Atmanirbhar Bharat priority industries is reduced to 1% for amounts between 10 and 20 crore; and

b) Term loans up to 20 crore for exporting MSMEs that are well-managed.

Microbusiness Credit Cards

Customised credit cards with a 5 lakh limit will be made available to microbusinesses registered on the Udyam site, according to Union Minister Smt. Nirmala Sitharaman. She said that 10 lakh of these cards will be distributed in the first year.

Fund of Funds for New Businesses

“The Alternate Investment Funds (AIFs) for startups have received commitments of more than 91,000 crore,” stated Smt. Nirmala Sitharaman, Union Minister for Finance & Corporate Affairs, in her Budget speech. The Fund of Funds, which was established with a 10,000 crore government contribution, supports these. She said that a new Fund of Funds would now be established with a broader scope and a new commitment of an additional 10,000 crore.

Plan for Novice Business Owners

A new program for 5 lakh women and first-time business owners from Scheduled Castes and Scheduled Tribes would be introduced, according to Smt. Nirmala Sitharaman, Union Minister for Finance & Corporate Affairs. Over the next five years, she said, this will offer term loans of up to 2 crore. “The plan will incorporate lessons from the successful Stand-Up India scheme,” she stated in her address. Additionally, there will be online capacity building for management and entrepreneurial abilities.

Fund of Funds for Deep Tech

As part of this strategy, a Deep Tech Fund of Funds would also be investigated to stimulate the next generation of companies, according to Smt. Nirmala Sitharaman, Union Minister for Finance & Corporate Affairs.

Mission to Promote Exports

According to Smt. Nirmala Sitharaman, Union Minister for Finance & Corporate Affairs, the Ministries of Commerce, MSME, and Finance would work together to establish an Export Promotion Mission with sectoral and ministerial goals. She said that the Mission will make it easier for MSMEs to deal with non-tariff barriers in foreign markets, assist cross-border factoring, and provide export finance.