“Silica Sand Soars: A 4.6% CAGR Journey from US$14.5 Billion in 2022 to US$22.7 Billion by 2032 in the Global Industrial Market” Fact. MR’s latest study on industrial silica sand market analyzes growth drivers, market restraints, and emerging trends. It also discusses the various methods used by leading industry competitors to achieve a competitive advantage in the industrial silica sand market.

In recent years, the global construction sector has expanded significantly, owing primarily to the development of new homes. The demand for housing and retail construction is critical in driving this increase. Notably, estimates from the US Census Bureau show a significant increase in the overall value of building, from USD 1.5 trillion in December 2020 to USD 1.6 trillion in December 2021.

Residential building, in particular, contributed significantly to this spike, hitting USD 714.0 billion in December 2020 and increasing by a notable 14.7% to USD 819.1 billion in December 2021.

Key Takeaways from Market Study

- In 2022, the global industrial silica sand market is expected to reach $14.5 billion.

- Global demand for industrial silica sand is expected to reach $22.7 billion by 2032.

- During 2017-2021, sales of industrial silica sand increased at 3.8% CAGR

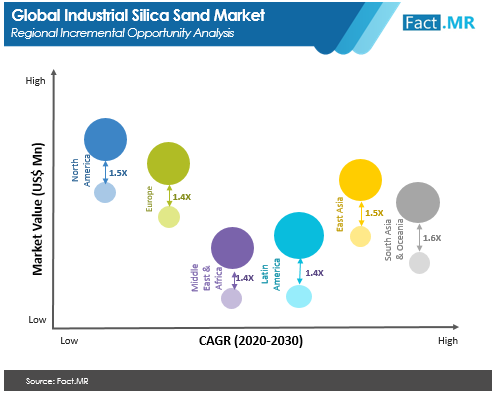

- North America tops the global industrial silica sand market accounting for 39.3% market share

- Glass manufacturing application of industrial silica sand accounts for 32.3% share of global sales

The construction industry uses a vast range of materials for various applications around the world. The worldwide construction sector has grown dramatically in recent years, owing to increased demand from a variety of end-use sectors. This increased demand needs a large volume of raw materials and intermediates for efficient construction production. As a result, this increase will have a direct beneficial impact on the worldwide industrial silica sand market.

It is critical to understand that the industrial silica sand industry is inextricably related to a variety of end-use industries and is not a standalone entity. The market’s growth is closely related to the advancement of these end-use industries. The performance of construction additives is predicted to have an impact on the growing construction industry, particularly in emerging nations. As a result, the construction sector’s robust growth drives the rise of the industrial silica sand market.

“Exponential Supply Gains for Silica Sand Have Been Achieved Due to the Growth in Hydraulic Fracturing”

Interest for silica sand as a proppant in the pressure driven breaking market is expanding at a critical rate. The fast improvement in the shale oil and gas market throughout recent years is a critical calculate the developing interest.

Oil and gas are separated from the bedrock utilizing pressure driven breaking, or deep earth drilling, which utilizes around 10,000 metric lots of silica per well. Subsequently, the interest for silica sand from the oil and gas area has decisively expanded.

The new unpredictability in modern silica sand might be relieved by expanded interest for high-grade silica sand for super advanced specialty items and modern glass.

Key Companies Profiled in Industrial Silica Sand Market Report

- Unimin Corporation

- Fairmount Minerals

- U.S. Silica

- Emerge Energy Services LP

- Badger Mining Corporation

- Hi-Crush Partners

- Preferred Sands

- Premier Silica

- Pattison Sand

- Sibelco

- Quarzwerke Group

“Bourgeoning O&G and Construction Industries Will Provide Mammoth Growth Opportunity to the Market Over the Valuation Period.” says a Fact.MR analyst.

The industrial silica sand market is moderately consolidated in nature. Therefore, key stakeholders in the market are implementing competitive policies such as mergers, acquisitions, and collaborations and exploiting untapped opportunities in the market to sustain and gain a higher market share. This strategy allows to broaden the company’s market share and enhance its economies of scale.

- U.S. Silica Holdings, Inc. has declared that the prices of the majority of its aplite, diatomaceous earth, clay products, and non-contracted silica sand will increase in April 2022. These products are primarily used in foundry, glass, roofing, chemicals, coatings, paints, elastomers, building products, recreation, agriculture, pet litter, and other applications. Depending on the product and grade, price increases will range from 8% to over 25%.

- The business strategy of Canadian Premium Sand Inc. was changed in February 2021 to focus on turning the Wanipigow silica sand deposition into a sustainable coating facility and float glass manufacturing. To create a new benchmark for low-carbon-footprint glass production, this facility is built to make the best use of current technology while focusing on sustainability initiatives like waste heat recovery and making the most of Manitoba’s plentiful and affordable renewable electricity.